Centralized Value Extraction vs Decentralized Value Sharing

13 min read

In a perfect free market, prices naturally gravitate toward their marginal cost of production. This principle ensures fairness in exchanges but poses a significant challenge for businesses: how can they sustain profitability in a system where competition drives pricing to the bare minimum? This question lies at the heart of the tension between centralized and decentralized economic models. Centralization often arises as a solution to overcome these challenges by creating defensible moats and mechanisms for value extraction, but it also leads to power consolidation and extractive economies. Decentralized systems, by contrast, offer an alternative path, emphasizing shared value and equitable distribution through innovative coordination mechanisms.

The Economic Problem: Defensible Moats and Profit Extraction

In order to maintain long-term profitability, businesses develop a "defensible moat". This strategic advantage allows businesses to extract value beyond marginal costs, achieving what is known as economic profit. Centralized business models rely heavily on this approach, where a central point of control orchestrates all economic inputs and outputs to establish and maintain dominance.

Through mechanisms of control and the creation of scarcity (whether real or artificial), centralized businesses generate non-zero-sum value, expanding the overall value pie. However, this structure inherently incentivizes profit extraction from users rather than value sharing. Efficiency gains are often redirected to owners, not customers, unless competitive forces compel otherwise. A clear example of this can be seen in the airline industry, where cost-cutting measures often lead to higher shareholder returns but negligible improvements in customer pricing.

Consider this: centralized platforms prioritize fortifying their monopoly power. For example, major e-commerce platforms use data-driven insights and economies of scale to undercut smaller competitors, maximizing pricing control and eliminating threats to their dominance. In the absence of robust competition or viable substitutes, this approach invariably leads to extractive economies. Centralized systems, by design, tilt incentives toward consolidating control, often at the expense of broader value distribution.

Centralization in Software Economics

The software industry provides a stark example of centralization’s effects, particularly in its approach to sustaining profitability through artificial scarcity. Since 2018, companies such as MongoDB, Confluent, HashiCorp, and Dgraph Labs have implemented changes to their open-source licenses to prevent cloud providers like AWS from capturing most of the value their software generates. These changes gave rise to the Business Source License (BSL), which introduced restrictions aimed at preserving these companies’ ability to monetize their software as a service.

Without these restrictions, open-source cores often become marketing tools for proprietary services, eventually abandoned in favor of products that generate direct revenue. For example, Nginx operates as an open-source web server, but the company behind it also offers Nginx Plus, a proprietary version with additional features and enterprise support. This model allows the open-source version to drive adoption, while the proprietary version becomes the main revenue source. Alternatively, businesses that rely on enterprise support as their primary income face incentives to overcomplicate their software, making it difficult for users to operate independently and effectively locking them into expensive "solution engineer" services.

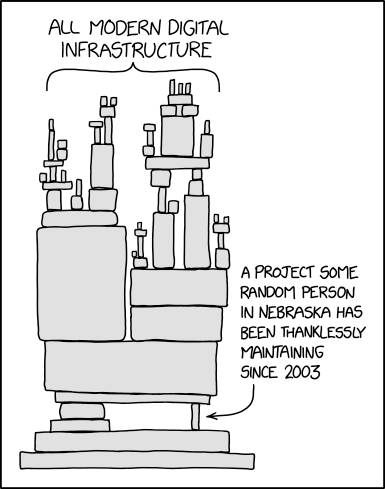

This underscores a broader issue: funding for significant open-source projects is rarely decentralized. Donations, while laudable, fail to provide the sustainable funding needed. As a result, centralized artificial scarcity becomes a default mechanism for profit extraction. However, the research and development process itself is inherently scarce—it requires labor, energy, and equipment, all of which must be compensated. Once software is created, its marginal cost of reproduction drops to zero, creating a unique economic challenge. Non-software businesses, which charge per unit of output, avoid this dilemma entirely.

There are parallels to industries such as pharmaceuticals, where high upfront costs for research and development are offset by low production costs post- discovery. Similarly, open-source businesses grapple with monetizing significant investment without creating exploitative models. For instance, infrastructure software like OpenSSL delivers immense value globally but struggles to capture enough to fund its development adequately.

This dynamic raises a key question: Are open-source businesses a temporary phenomenon - a stopgap until the socio-technological environment matures—or can they evolve into models that sustainably balance decentralization and innovation?

Decentralized Alternatives

The limitations of centralized systems in software development and beyond point to the need for innovative approaches that prioritize fairness and shared value. Decentralized systems offer a compelling alternative by aligning incentives among all participants and enabling new governance models. These systems challenge monopolistic tendencies by leveraging technologies like blockchain and DAOs, which provide frameworks for large-scale coordination and equitable value distribution.

Economics hinges on aligning incentives to coordinate resource use effectively. Decentralized systems - particularly in the crypto space - are forging new paths in economic governance, offering exciting opportunities for small-scale economic experimentation and scaling. These systems challenge centralized monopolies, which often rely on regulatory oversight - a system prone to regulatory capture. By design, decentralized alternatives align incentives more equitably among participants, fostering innovation and fair resource distribution.

Decentralized Autonomous Organizations (DAOs), for example, demonstrate that large-scale coordination and capital accumulation are achievable without centralized authority. Meanwhile, emerging technologies like solar panels, batteries, and blockchain protocols are transforming industries previously constrained by traditional centralization. These decentralized innovations provide models for alternative energy systems, finance, and digital services.

- Cryptocurrencies vs Visa, Mastercard, and Government-Issued Currencies Cryptocurrencies redefine value transfer by enabling decentralized, peer-to-peer transactions without intermediaries. Unlike centralized systems like Visa, Mastercard, or national currencies managed by central banks, cryptocurrencies operate on networks immune to manipulation or control by a single entity. This ensures transparency, neutrality, and resistance to censorship, making them truly global and borderless. While critics argue that cryptocurrencies lack intrinsic value because they aren't backed by governments, this is precisely their strength. Their independence from central authority protects them from inflation, sanctions, and political interference, offering a neutral and fair alternative for transferring and storing value. Networks like Bitcoin's Lightning or Ethereum’s Layer 2 solutions (e.g., Arbitrum, Optimism) enhance scalability and cost-efficiency, enabling decentralized systems to compete directly with traditional payment systems. By removing centralized control, cryptocurrencies empower individuals and create a resilient financial ecosystem that prioritizes accessibility and fairness over monopoly and control.

- Radicle vs GitHub Radicle enables peer-to-peer code collaboration without central ownership, standing in stark contrast to Microsoft-owned GitHub. By decentralizing repository hosting, Radicle resists censorship and unilateral policy changes, empowering developers directly.

- Aave vs Banks Aave’s decentralized finance (DeFi) protocol facilitates collateralized lending without the need for traditional banking intermediaries. This model democratizes access to financial services, reducing barriers and fees.

- DEXs vs Centralized Exchanges Decentralized exchanges (DEXs) such as Uniswap allow users to trade directly with one another through smart contracts, eliminating the risks associated with centralized authorities like hacks and regulatory interference.

- IPFS/Filecoin vs AWS S3 IPFS and Filecoin offer decentralized, distributed data storage solutions that challenge the centralized dominance of cloud providers like AWS. These protocols enhance resilience and censorship resistance.

- Helium vs Telecom Networks Helium’s model incentivizes individuals to deploy wireless hotspots, creating decentralized networks for IoT devices and reducing infrastructure costs compared to traditional telecom networks.

- Rarible vs Centralized Marketplaces Rarible’s community-governed NFT marketplace decentralizes power, allowing creators and users to shape its development and decision-making processes. This contrasts with extractive centralized platforms.

- Arcade City vs Uber Arcade City decentralizes ridesharing, enabling drivers and riders to negotiate directly without the intermediation of a corporate entity, thereby redistributing power and value.

- Akash Network vs AWS Akash offers a decentralized cloud computing marketplace, allowing data centers to rent excess computing power. This reduces costs and fosters a more competitive and censorship-resistant cloud ecosystem.

- Arweave vs Cloudflare Arweave ensures permanent, tamper-proof data storage via a decentralized network, directly challenging centralized content delivery networks like Cloudflare.

- Ethereum Name Service (ENS) vs DNS The Ethereum Name Service (ENS) offers a decentralized alternative to the traditional Domain Name System (DNS). ENS uses blockchain technology to create a trustless system for domain name registration, giving users complete ownership and control over their domain names. This decentralization reduces the risks of censorship and domain seizure, making ENS a more secure and resilient option for the future of web infrastructure.

- Network State Coliving Spaces vs Traditional Rental Models Network State coliving spaces present a potential new model for community governance and capitalization. Unlike traditional rental arrangements, these spaces enable users to hold a stake in their living environments, fostering better liquidity, transparency, and automation. While similar to existing co-op structures, Network State coliving leverages blockchain technology to align incentives and streamline governance. This creates a more dynamic housing model where value is not merely extracted as rent but reinvested to benefit all participants, transforming housing from a commodity to a collaborative ecosystem.

- Solar Panels, Batteries and Micro Grids vs Traditional Power Companies Decentralized energy solutions, often categorized under DePin (Decentralized Physical Infrastructure Networks), leverage solar panels, battery storage, and microgrids to empower communities and individuals to generate, store, and trade energy independently of traditional power companies. These systems enable localized energy production, peer-to-peer trading, and grid resilience by isolating from centralized systems during outages. DePin energy solutions use blockchain technology for transparent transactions, dynamic pricing, and equitable energy distribution. In contrast, traditional power companies operate centralized infrastructures prone to inefficiencies, monopolistic pricing, and large-scale outages. By democratizing energy access and fostering innovation, decentralized energy networks promote sustainability and empower communities to achieve energy independence.

- Public Goods Funding via Quadratic Funding vs Taxes/Donations Quadratic funding (QF) introduces a decentralized, community-driven alternative to funding public goods, contrasting with traditional models like taxes or donations. Platforms such as Gitcoin and Drips Network allocates resources more equitably by amplifying contributions from a broad base of smaller donors. This ensures that funding decisions reflect the preferences of the many rather than the influence of a few large contributors. Unlike taxes, which rely on centralized government allocation, or donations, which can be sporadic and opaque, QF maximizes impact through transparent and democratic funding mechanisms. By incentivizing widespread participation, quadratic funding aligns incentives to efficiently support shared resources and public goods, demonstrating the power of decentralized solutions in fostering collective well-being.

Decentralized systems excel in turning centralized weaknesses into opportunities for innovation. One of the most revolutionary aspects of decentralized systems is their inherent openness. Unlike traditional centralized platforms that thrive on competition and work to create defensible moats, decentralized systems encourage cooperation. These systems are built on the idea of interoperability and the ability to build value on top of existing platforms rather than tearing them down.

In the traditional startup ecosystem, "creative destruction" or "disruption" is often seen as a driving force—new technologies emerge, old ones are destroyed, and market leaders are replaced. However, in decentralized ecosystems, the focus shifts from destruction to cooperation. Cross-chain technologies are a prime example of this. They enable different blockchain networks to communicate and interact, allowing value to flow freely across different systems. This means that instead of replacing older systems, new decentralized platforms can build upon and enhance them, creating additional value without the need for destructive competition.

As Lyn Alden discusses in her post about open networks, these systems operate on principles of openness and interoperability, allowing multiple networks to coexist and complement each other rather than compete destructively. This cooperative nature of decentralized systems may also mean that decentralized monopolies, if they ever form, would look very different from traditional monopolies. In a decentralized ecosystem, even if a platform becomes dominant, its open nature means that other platforms can still interact and build upon it, reducing the risk of extractive practices. The result is a system where value is continuously created and shared, rather than concentrated and extracted.

One of the most intriguing aspects of decentralized systems is their ability to enable small-scale economic experiments that were previously impossible under centralized frameworks. These experiments allow developers and entrepreneurs to test new ideas, governance models, and economic incentives on a smaller scale before scaling them up.

For instance, while Arcade City and Origin Protocol faced challenges and paused their development, the experiments they initiated laid the groundwork for future decentralized platforms. These trials contribute valuable insights and refine the underlying concepts, which are likely to be reattempted with adjustments to smart contract models and incentive structures. When these decentralized alternatives succeed, they often have greater longevity than centralized systems, which can be abruptly shut down or altered by their owners.

This potential for enduring success is rooted in the decentralized model itself, where control is distributed, and the community plays an active role in governance. As a result, decentralized platforms are more resilient to the whims of single entities and more adaptable to the evolving needs of their users. These systems, especially in the context of emerging blockchain technologies—enable economic coordination without central authority. Unlike centralized models, where value is often extracted from users, decentralized alternatives focus on generating value through the enhancement and maintenance of the protocol itself. Users, incentivized through ownership, have a vested interest in the protocol’s success, aligning incentives across the ecosystem. When done effectively, decentralized systems promote value creation and equitable sharing rather than extractive practices.

Two-sided marketplaces like Airbnb, Uber, and eBay illustrate the centralization problem vividly. These platforms thrive on network effects, where their value grows as more users (buyers and sellers, drivers and riders, hosts and guests) participate. However, they are centralized entities that extract value by imposing fees and commissions. Decentralization offers a compelling alternative by reducing dependence on extractive intermediaries, allowing for fairer value distribution and governance by participants themselves.

Centralization, while advantageous for managing economies of scale, often leads to power consolidation, which increases the risk of corruption and value extraction. However, decentralization introduces its own set of challenges, including scalability, user adoption, and governance complexities. These systems require robust coordination mechanisms to avoid inefficiencies and ensure equitable value flows. Yet, recent advancements in blockchain technologies, smart contracts, and decentralized governance models demonstrate that these challenges can be mitigated. When implemented effectively, decentralization not only addresses power consolidation but also fosters innovation and resilience by aligning incentives across a distributed network.

Crypto-Economic Experiments

At Matrix AI, we are actively exploring crypto-economic experiments using protocols like AAVE, Rocketpool, and Polykey as part of our broader investigation into decentralized systems.

Polykey, a decentralized secrets manager could evolve into a robust decentralized trust infrastructure. This infrastructure would incentivize not only the creation and maintenance of trust claims but also their verification and reputation management. By leveraging open reputation systems, Polykey could enable cross-border credit rails for world-wide peer-to-peer undercollateralized micro-loans, fostering trust and enabling financial inclusion at a global scale. Additionally, Polykey aligns with models like Gitcoin for public goods funding, where decentralized reputation systems ensure transparent allocation of resources. This vision extends to Polykey's Decentralized Trust Network, designed to coordinate trust and claims across a global, decentralized network, addressing enterprise needs while expanding into public authority applications with scalable and transparent solutions.

Our Zeta House project exemplifies how Matrix AI applies decentralized principles in the real world. In the future, Zeta House aims to expand into broader decentralized governance models. By enabling residents to hold stakes in their living spaces, Zeta House fosters community ownership, enhances liquidity, and ensures transparent governance. This approach bridges theoretical decentralized models with tangible outcomes, offering insights into the challenges and opportunities of implementing decentralized systems in everyday life. Future milestones include expanding its operational framework and integrating blockchain-based governance tools to further align resident incentives with shared goals.